MultiVol: A diversified approach to volatility trading

- MultiVol trades XIV and VXX with a backtested CAGR of ~90% and Sharpe ratio > 1.0.

- MultiVol stacks 12 different strategies to provide a diverse suite of volatility risk premium (VRP) signals with minimal optimization applied.

- MultiVol can be used as a standalone strategy for IRAs or other accounts, or it may be utilized as a volatility-risk filter for other trading strategies.

MultiVol is a new strategy I’ve been working on for months. I’ve been trading it live since mid-December, and it’s doing fine (up about 6% in a mixed market for vol). MultiVol is a quantitive strategy for trading volatility ETPs (XIV, VXX) based on multiple VRP measures. I calculate the VRP 12 different ways, and stay short vol (XIV) if NO signals are LONG, go to cash if 1-6 signals are LONG, and go long vol (VXX) when more than half (7+) of the VRP signals are LONG . It’s a conservative approach (i.e., not many days are spent long vol), with a high daily win rate (near 60%) and backtested CAGR around 90%.

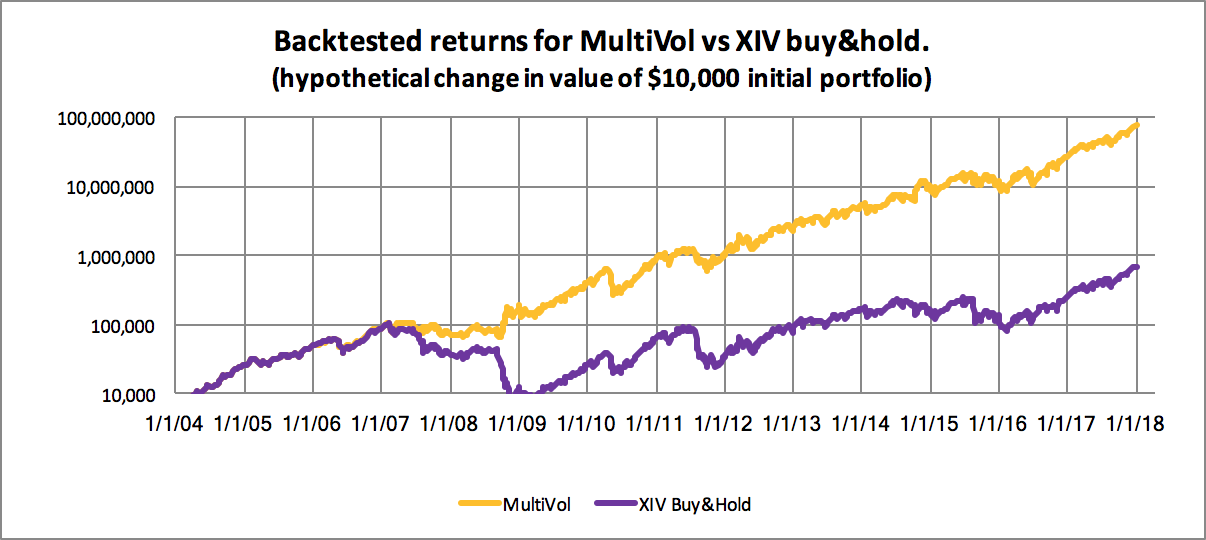

This is just a preview post, just to whet appetites and let folks know something is coming up. Here’s what the equity curve looks like:

The only down year is 2007, and that’s quite modest (about -11%). More difficult was the extended drawdown there, that lasted from Feb 2007 to Oct 2008… it was a difficult time for vol strategies.

One of the exciting things about MultiVol is that the process of stacking up 12 VRP strategies allows us to increase the signal to noise ratio, so that we’re more likely to be chasing the actual VRP signal and not just looking at market noise. In the full article I’ll include some statistics supporting this, but the short of it is that MultiVol has more consistent 2-year returns than any of the 12 component strategies. MultiVol does NOT produce a higher CAGR than the best strategies, but it produces a more linear equity curve with more consistent returns (see above).

Finally, MultiVol seems to be more than just a decent standalone volatility strategy. I’m investigating several ways of combining MultiVol with other (non-VRP) vol strategies with very interesting results… similar returns and lower drawdowns. So I’m starting to look at MultiVol as a platform for developing more and different vol strategies in the future.

If any of you are interested in reviewing the MultiVol article before I publish it, let me know and I’ll put you on the list to see it a few days before launch.

UPDATE: post-volpocalypse.

That preview was from a week or so before the vol crash that killed XIV, which was the Bad News. The Good News is that MultiVol survived the crash (in cash) and is performing well, and should work with any short vol trade (ie, ZIV, VMIN, SVXY, shorting VXX, shorting VIX futures, etc). I wouldn’t recommend XIVH, because it’s so actively managed that at times it is a long vol product, not a short vol product. Returns are lower with ZIV and new SVXY than shown here with full strength XIV, but so are drawdowns. More soon!