Ready to subscribe?

Here's a link to the Battle Axe Volatility strategy on Collective2:

Battle Axe on C2The subscription fee for Battle Axe is $100 per month, and there's a 15day free trial period. If you're not already a C2 member, it's free to join so that you can explore all the trading strategies, but you'll need to upgrade to a $99/month Premium package in order to subscribe to strategies, Autotrade your account, etc. Battle Axe only launched on March 2, 2017 so our public track record is not long yet, but we're here for the long run (our own money is trading Battle Axe too).

About Collective2 (C2) and subscribing: Collective2 is a trading site, where market traders publish trading signals from their strategies and investors subscribe to those trading signals. Battle Axe is just one of dozens of volatility strategies, and of thousands of other strategies for trading stocks, options, futures, forex, and combinations of those, depending on the strategy selected. Investors pay C2 fees for becoming an investor and subscription fees to the traders.

Particularly useful is that an investor can connect their qualified investment account up to "AutoTrade" their selected strategy(ies). This means you can start a fresh trading account (properly sized), set it up to AutoTrade with Battle Axe volatility strategy, and with every trade we place in our connected account, the trading signal we generate (e.g., sell VXX and buy XIV) will automatically be AutoTraded in your connected account, usually within moments. Alternatively you can opt to receive trading signals by email or text message and place your own trades manually.

Read more about Battle Axe:

Battle Axe is our hard-hitting volatility strategy offered via subscription at Collective2. Battle Axe is a switching strategy that is invested nearly 100% of trading days in either short-vol XIV (an inverse volatility ETN) and long-vol VXX (a long volatility ETN). This is a quantitative, algorithmic approach that trades at a fairly low frequency: on average it trades 1-2 times per month, but may stay long XIV for months at a time in favorable market conditions. We also reserve the right to enter a discretionary trade if market conditions warrant an override of the algorithm.

Basis: Our strategy is proprietary, but builds on the wealth of published information about the growing volatility trading market. At its heart Battle Axe is a VRP-based strategy, taking advantage of the Volatility Risk Premium to tell us whether it's currently advantageous to be long vol (VXX) or short (i.e., long inverse vol, or XIV). On top of our high performing VRP-basis, we layer proprietary filters for roll yield and other factors that have a high statistical correlation with outperformance. Together these improvements give Battle Axe higher expected returns, lower drawdown, and improved risk-adjusted returns compared with even the very best VRP-based strategies.

Plain language: Some investors hedge their stock market investments with volatility instruments, paying a premium to lower their risk. This is the so-called Volatility Risk Premium, and our aim is to harvest that premium. It's a bit like selling insurance (us) to those hedgers (them). But we get to go both ways here... we can sell or buy volatility, depending on how we think markets are going. When markets are quiet and volatility is generally low, it pays to be a seller of volatility (for Battle Axe, that means buying XIV, the inverse volatility ETN). During market turmoil when volatility is likely to spike, we buy volatility (buy VXX). To determine which direction to go (short vol or long vol), we use several indicators that are statistically validated to take advantage of these trends. The simplest of these measures is simply to compare the VIX (an estimate of implied, or predicted volatility for the S&P 500) to the recent historical, or realized volatility. Most of the time (quiet, rising markets), the VIX is higher than the realized vol... investors fear/expect higher volatility. But when markets panic, the realized volatility can skyrocket and the VIX will lag behind, due to the expectation (by market makers) that the markets will settle down in the future.

More plain speak: So all we really do is give you the trading signals we discovered that say whether you're likely to do better tomorrow in XIV or in VXX. We think our trade-switching signals are the best in the business... our public track record at C2 will prove us right in the months and years ahead. Battle Axe is a long-range strategy, suitable for (even designed for) usage in an IRA or other tax-advantaged account.

Backtesting: Backtesting is the backbone of quantitative algorithms, the proving ground where trading ideas are tested. It's also a place for the uninitiated to fool themselves with their modeling prowess. We have backtested Battle Axe and its predecessors for many months and are only now satisfied with our improvements to be offering it publicly as a strategy for traders. We have improved performance substantially over published VRP strategies, both in terms of absolute returns and risk-adjusted returns.

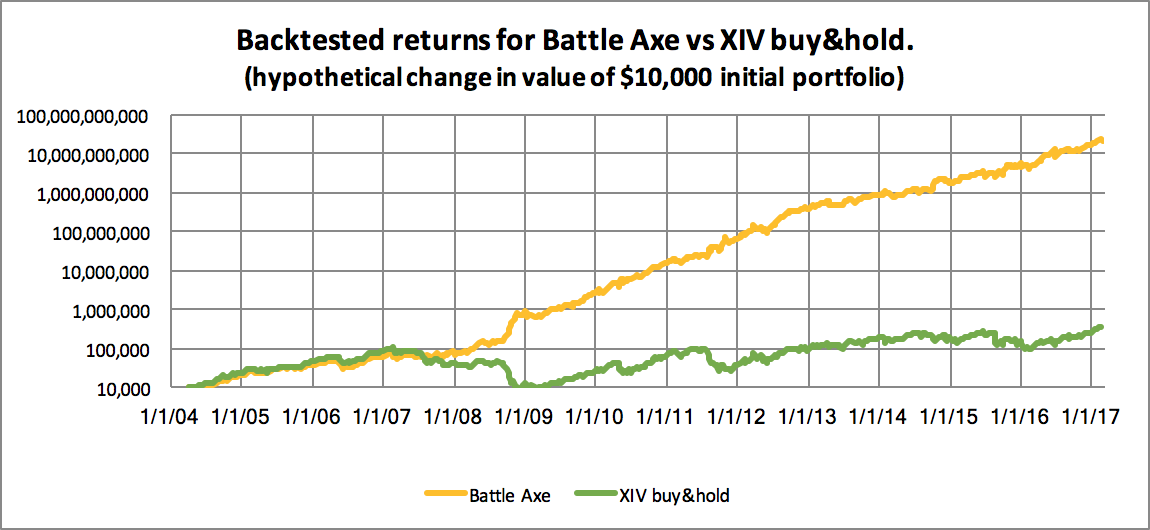

Results: Here's a graph of the returns for Battle Axe since April 2004. Note that XIV and VXX have only existed as ETN products since 2010, but a synthetic record of their approximate historical prices are readily derived from the VIX futures prices that do date back to 2004... results since late 2010 reflect actual (not synthetic) historical prices.

A buy and hold investment in XIV would have performed extraordinarily well, with greater than 40% CAGR averaged over the testing period. In its first three years, XIV would have returned 10x the original investment (and Battle Axe was not far behind). But as volatility began picking up in 2007, XIV began underperforming and Battle Axe began pulling ahead. The terrible drawdown late-2008 for XIV was instead a huge gain for Battle Axe, which gained over 1000% in 2008. After that there's been no competition. Battle Axe has an average gain of more than 200% in this backtest with no losing years. This graph, of course, has a logarithmic scale on the Y-axis, where each bar is a ten-fold increase from the initial $10,000 investment.

A buy and hold investment in XIV would have performed extraordinarily well, with greater than 40% CAGR averaged over the testing period. In its first three years, XIV would have returned 10x the original investment (and Battle Axe was not far behind). But as volatility began picking up in 2007, XIV began underperforming and Battle Axe began pulling ahead. The terrible drawdown late-2008 for XIV was instead a huge gain for Battle Axe, which gained over 1000% in 2008. After that there's been no competition. Battle Axe has an average gain of more than 200% in this backtest with no losing years. This graph, of course, has a logarithmic scale on the Y-axis, where each bar is a ten-fold increase from the initial $10,000 investment.

Warning! Backtesting results are ALWAYS exceptional, because backtests are used to prove that a strategy is worthwhile. Ours are no exception to this rule; this is among the most amazing long-term backtest returns graphs you'll see anywhere.

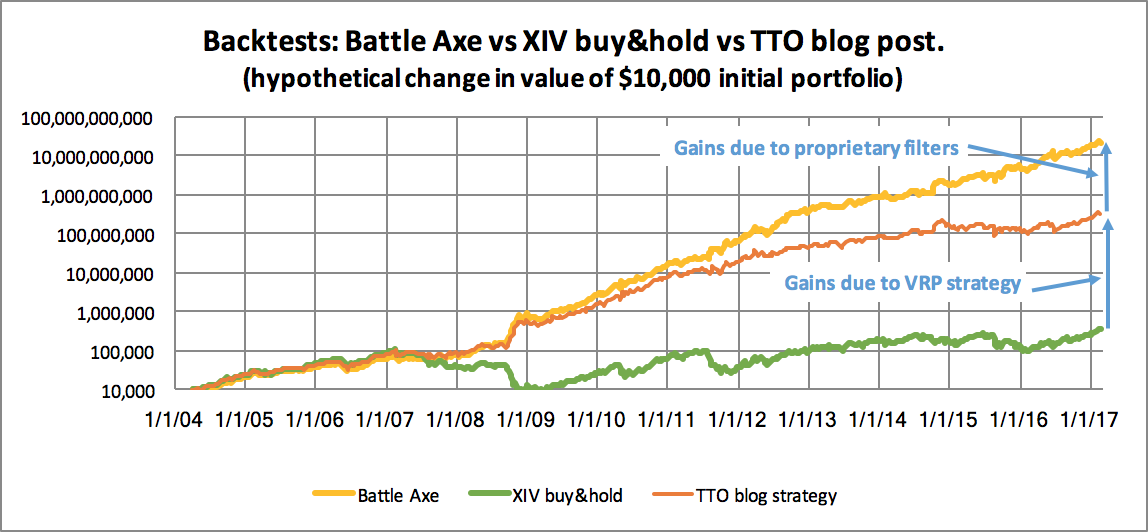

That said, we'll show you another backtest graph. It's the same as the first one, except we've added one more volatility strategy return curve, published back in November of 2014. It's a great strategy, and at the time was significantly better than any other published volatility strategies. Battle Axe outperforms this strategy handily, and greatly outperforms it over the 2015-date period.

The new curve labeled "TTO blog strategy" comes from a blog post on TradingTheOdds.com. We've approximated it as best we can (certain details were omitted in the published blog post about how to duplicate the extraordinary returns). If we look at the TTO strategy as being the best of the plain vanilla VRP strategies, then the graph easily shows how a VRP-based strategy greatly improves upon the XIV bay-and-hold strategy. Drawdowns are reduced or even turned into huge gains by strategically switching into VXX when advantageous.

Unfortunately, if you look closely on the chart, you'll see that November 2014 was a high point for the TTO blog strategy... it proceeded to fall into early 2015 and never recovered until near the end of 2016, a two-year drawdown. Very few volatility strategies faired well in 2015; it was a particularly difficult year because both XIV and VXX suffered net losses for the year. 2016 was a different beast altogether (XIV way way way up from initial lows in Jan-Feb).

Unfortunately, if you look closely on the chart, you'll see that November 2014 was a high point for the TTO blog strategy... it proceeded to fall into early 2015 and never recovered until near the end of 2016, a two-year drawdown. Very few volatility strategies faired well in 2015; it was a particularly difficult year because both XIV and VXX suffered net losses for the year. 2016 was a different beast altogether (XIV way way way up from initial lows in Jan-Feb).

The difference between our Battle Axe strategy curve and the TTO blog strategy curve results from the proprietary filters we've added. We studied the problems in the VRP strategy... under what conditions does it lose ground? what causes those drawdowns? how can we improve the overall returns? The difference is striking... Battle Axe has a final portfolio value nearly two orders of magnitude greater than what TTO finished up with. TTO's strategy is no slouch (>120% CAGR over 13 years, though with slower growth the past few years), but it's eclipsed by Battle Axe at over 200% CAGR with smaller, shorter drawdowns.

One more note: We didn't add the S&P 500 on here for scale, because it's a bit sad. Remember, it's a log scale for the Y-axis, so the SP500 will look a lot like the X-axis, a bit more than doubling from $10,000 to $24,000 or so with dividends compounded (ah, sweet dividends). Battle Axe is a long-range strategy, suitable for (even designed for) usage in an IRA or other tax-advantaged account.

Drawdowns: Because it is unhedged and invested >99% of market days, Battle Axe will suffer drawdowns, and investors should invest in it for the long run (recommended two-year minimum outlook). Although drawdown periods in backtesting typically last only a few months to as many as 6 or 7, there was a more extended drawdown of nearly 13 months in the 2007-2008 period. The worst backtested drawdown since 2004 is less than 40%; compare that to the S&P 500 during the financial crisis! Another way of looking at this: there are no full 13 month periods in the backtesting period that show a net loss, and most 13 month periods show very substantial gains.

Returns: We expect annual returns greater than 100% in the future. Our backtested yearly returns range from 19% (in 2007) to over 1000% (in 2008) with a median value of 185% since 2004 when our data starts. The biggest unknown (and hence, most important variable for optimization during backtesting) in most VRP strategies is the lookback period. Our strategy is robust across a ridiculously wide range of lookback values: although the highest returns cluster around our chosen optimized lookback period, returns from even the most poorly performing lookback periods were over 100% annually for the backtesting period.

In sum, Battle Axe is an unhedged volatility strategy with significant long-term upward potential. Backtesting results are substantially stronger than any published XIV/VXX switching strategies, with lower drawdowns and better risk-adjusted returns due to our proprietary filter layering approach. Further, we're not sitting on our hands, we have identified several areas where the strategy underperforms (Hello, 2007?) and we have no expectation that market conditions in future years will resemble those we've seen in the recent past. Research and modeling continue and we expect the algorithms used by Battle Axe to evolve accordingly, and without notice.

Caveats: Backtested returns are optimized, of course, and future results cannot be guaranteed. Further, your worst strategy drawdown is always in your future, not your past, and certainly not in your backtested past. You should read about and understand the volatility funds traded in volatility strategies (e.g., long vol VXX and inverse vol XIV) before you consider investing with anyone's published strategy signals, including ours. Certain unusual market conditions (e.g., very sharp volatility spikes) could potentially lead to significant losses when invested in inverse volatility funds. And none of this is advice, financial or otherwise. We publish some trading signals that we think have value, and if you think they may have value to you, you can subscribe to receive them. We don't offer anything but our published signals, and we can't tell you if our signals are right for you. Get advice from someone else, get volatility trading signals from us.

IRA Trading Caveats: The only caveat about using Battle Axe in an IRA is that it must be capable of selling and buying (i.e, switching funds) on the same day (within moments, preferably). This means there must not be a 3 day "settlement" period for the selling funds before deploying back in as a purchase! Most brokers do not allow this in their IRA accounts. We use IB (InteractiveBrokers.com) specifically for this reason. We further use IB because they are easy to set up to AutoTrade with your Collective2 strategies. And, of course, we personally expect to have such impressive profits over the next decade trading Battle Axe that we are set up as a Roth IRA account, so as not to have to worry about the taxes when we start taking profits out someday (this is not advice for you, just sharing our story).

For more information about this strategy or any of our work, you may contact us at info@v1trader.com and we'll respond promptly.